CORE7 NETWORKING GROUPS

Primary Referral Scripts For All Pros

Fact Finders

1 on 1 PARTNERSHIP PLANNING WORKSHEETS

QUICK START CHECKLIST

MORTGAGE JUMPSTART

Day #1: Start With The Right Business Mindset

What's Your Rate? E-Book

Day #2:Building Your Database

Mortgage Jumpstart Database Builder

Day #3-8 ( part 1) Create A Process To Obtain And Gather Loan Documentation Up Front.

Core7 Loan Application that Populates

Mortgage Planning Questionnaire that Populates

Documentation Checklist

Script-Handling Pushback on Docs

Script- requesting docs on a refi

Day #3 - #8: (part 2) Schedule The Loan Consultation And Receive Permission To Send The Pre-Consultation Worksheets.

Core7 Loan Application that Populates

Mortgage Planning Questionnaire

Day #9: How Much Do You Want To Learn? And How Many Closings Do You Need?

Your Business Plan

Mortgage Jumpstart Income Calculator

Day #10: Choosing A Closing Attorney Or Escrow Officer

Core7 Attorney Package

Core7 Attorney Package-Wire Instructions

Day #11: Partner Prospecting Interviews

Referral Partner Presentation

Realtor Partner Presentation Overview

Realtor Partner Presentation

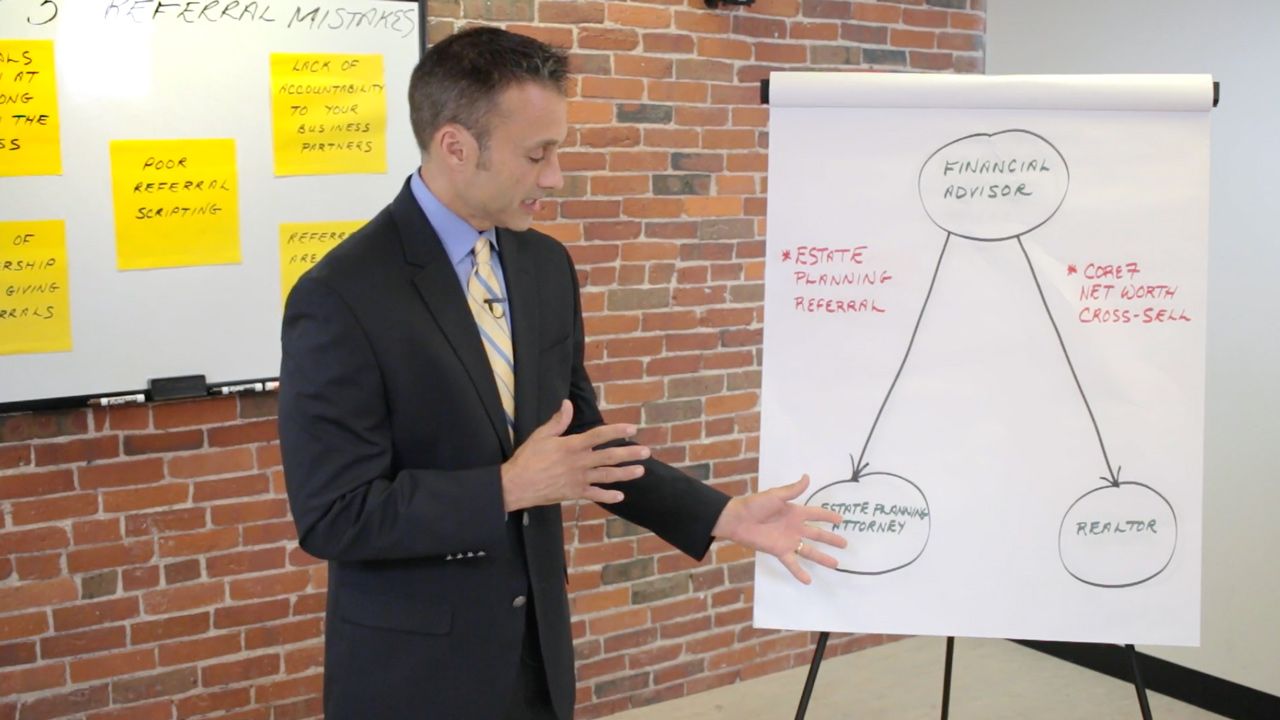

Financial Partner Presentation Overview

Financial Advisor Partner Presentation

Day #12: Call On Your Prospects Introduced By Your Attorney Or Escrow Officer

Core7 Recruiting Package Information Package

Core7 Recruiting Package- Prospecting Letters & E-Mails

Day #13: Where Will You Get Your Business? The Business Pillars.

Annual Mortgage Review Introduction

Script to offer Mortgage Review

Mortgage Review Document

Lunch & Learn Overview

Lunch & Learn Email to client for permission to speak to a decision maker

Lunch & Learn Email to H.R Contact

Lunch & Learn Feedback Form

Day #14: Create A Referral Directory

Core7 Partner Prospector

Mortgage Jumpstart Prospecting Letter #1

Mortgage Jumpstart Prospecting Letter #2

Mortgage Jumpstart Referral Directory

Day #17: Creating Your Introduction Letter For Prospecting

Mortgage Jumpstart Realtor Prospecting Introduction

Mortgage Jumpstart Realtor Prospecting Follow up #1

Mortgage Jumpstart Realtor Prospecting Follow up #2

Mortgage Jumpstart Realtor Prospecting No Response Follow up #1

Mortgage Jumpstart Realtor Prospecting No Response Follow up #2

Day #19: Start A Core7 Mastermind Group

Core7 Mastermind Agenda

Core7 Tracking Matrix Cheat Sheet

Core7 Recruiting Package- Information Package

Day #20: Find A Credit Repair Expert

What's Your Rate E-Book

Day #21: Create Your Daily Schedule

Annual Mortgage Review Introduction

Annual Mortgage Review Document

Annual Mortgage Review No Response Email

CORPORATE LUNCH & LEARNS

MARKETING

LUNCH & LEARN - Team Services Discount

LUNCH & LEARN - REALTOR- Existing Client Benefit Package

LUNCH & LEARN - Rate Watch

LUNCH & LEARN - Pre-Approval

LUNCH & LEARN - Overview

LUNCH & LEARN - Existing Client Mortgage Benefits

LUNCH & LEARN - Legal Services Discount

LUNCH & LEARN - Corporate Mortgage Benefit

LUNCH & LEARN - Corporate Mortgage Benefit Marketing Flyer

LUNCH & LEARN - Corporate Mortgage Benefit Flyer

LUNCH & LEARN - Corporate Mortgage Benefit Flyer

LUNCH & LEARN - Feedback Form

LUNCH & LEARN - H.R Email

LUNCH & LEARN - Client Permission Email

LUNCH & LEARN - Attorney Flyer

RESOURCE- Sample Lunch & Learn Seminar

THE CORE7 MORTGAGE ORIGINATOR

Mortgage Module #1

Checklist - Mortgage Module #1

Core7 Loan Application

Core7 Loan Application that Populates

Mortgage Planning Questionnaire

Mortgage Planning Questionnaire that Populates

SCRIPT TO SCHEDULE THE LOAN CONSULTATION/EXPLAIN THE PROCESS

SCRIPT TO SCHEDULE THE LOAN CONSULTATION/ENDORSE REFERRAL SOURCE

SCRIPT TO SCHEDULE THE LOAN CONSULTATION/EMAIL QUESTIONNAIRE

SCRIPT-Schedule loan consult. -client hasn't decided to work w/Referral Source

Referral Partner Presentation

Referral Partner Presentation Financial Advisor

Realtor Partner Presentation Overview

Financial Advisor Presentation Overview

Do's & Don'ts When Obtaining A Mortgage

Documentation Checklist

Email to schedule the Loan Consultation for a Purchase/Request docs

Email to schedule the Loan Consultation for a Refinance/Request docs

Email- referral partner endorsement if client has not committed to working w/them

Email To Endorse A Referral Partner

Mortgage Module #2

Checklist - Mortgage Module #2

Loan Application

Core7 Loan Application that Populates

Mortgage Planning Questionnaire

Mortgage Planning Questionnaire that Populates

Documentation Checklist

Script requesting documentation for a refinance

Script for handling pushback when requesting documentation

Do's & Don'ts When Obtaining A Mortgage

Mortgage Module #3

Checklist - Mortgage Module #3

Loan Application

Core7 Loan Application that Populates

Mortgage Planning Questionnaire

Mortgage Planning Questionnaire that Populates

Script to reschedule when Docs Not in

Script to refer realtor for an Equity Assessment

Script to refer Financial Advisor (Retirement)

Script to a client w/out a Financial Advisor

Script-Financial Advisor received a low rating

Script-Financial Advisor received a high rating

What Makes Us Different

Resource- NPNC Refinance- Why do I need $ to close?

Lunch & Learn Presentation

Closing Costs Needed

LUNCH & LEARN- Team Services Discount

Documentation Checklist

LUNCH & LEARN- Realtor Existing Client Benefit

LUNCH & LEARN- Rate Watch

LUNCH & LEARN- Pre-Approval Flyer

LUNCH & LEARN- Existing Client Mortgage Benefits

LUNCH & LEARN- Legal Services Discount

LUNCH & LEARN- Corporate Mortgage Discount Program

LUNCH & LEARN- Why you want a Mortgage Discount Program

LUNCH & LEARN- Mortgage Discount Program Flyer

LUNCH & LEARN- Mortgage Discount Program Flyer #2

LUNCH & LEARN- Feedback Form

LUNCH & LEARN- H.R E-mail

LUNCH & LEARN- Client permission E-mail

LUNCH & LEARN- Corporate Benefits Flyer

LUNCH & LEARN- Attorney/Escrow Officer Flyer

LUNCH & LEARN- Tri-Fold Flyer

FLYER- Lunch & Learn Presentation

FLYER- Lunch & Learn Presentation #2

Email that goes with What Makes Us Different

Email- P&C Full Coverage Review

Email- P&C Follow up Email

Email- P&C Cross-Sell Refinance

Email- P&C Cross-Sell Purchase

Email- RE: Large Deposit

Email- RE: Closing Costs

Email follow Up if no contact re: Cash Flow Analysis

Email RE: NPNC Refinance

Email RE: Client possibly needing to increase Insurance

Email RE: Realtor Equity Assessment

Email RE: Financial Advisor Referral

Email RE: Financial Advisor Referral to client who has no F.A

Email RE: Financial Advisor Referral to client who received a low rating

Email RE: Financial Advisor Referral to client who received a high rating

Email RE: Financial Advisor Referral (COMPROMISE)

Email RE: Financial Advisor Closing Referral (Earlier)

Email RE: Financial Advisor Closing Cross-Sell Referral

Email RE: Financial Advisor Closing Referral (Client has an advisor)

Email RE: Financial Advisor Cash-Flow Cross Sell

LUNCH & LEARN- Corporate Mortgage Benefit Program (Overview)

Closing Cost Buckets

Estimated Closing Costs breakdown

Mortgage Module #4

Script-Cash Flow Analysis Cross-Sell

Probing questions

Pre-Approval letter

Mortgage Qualifying Worksheet

Email w/Pre-Approval Letter

Pre-Aproval email sent if client has not committed to working w/Referral source

Checklist - Mortgage Module #4

Mortgage Module #5

Checklist - Mortgage Module #5

SCRIPT- To schedule review of options

Script-Client wants to shop

SCRIPT- .125% policy

Full Consultation

Do's & Don'ts When Obtaining A Mortgage

Disclosure Package Doc

.125% Policy

Property Information Sheet

Email- Application submitted to process

EMAIL- Team introduction

EMAIL- Locking In/Interest Rates

Rate Movement Article

Mortgage Module #6

Checklist - Mortgage Module #6

Pre- Qualification Letter

Pre-Approval letter

Loan Qualification Worksheet

EMAIL- w/Pre-Qualification

Pre-Qualification if client has not committed to working w/Referral Source

EMAIL- w/Pre-Approval

Pre-Approval email sent when client has not selected the referral source

Mortgage Module #7

Checklist - Mortgage Module #7

SCRIPT- Re-Consultation Agenda

SCRIPT- Permission to review financial team

SCRIPT- Interest rate example

Script for handling client pushback when referring

Script for handling client pushback when referring (No ADVISOR)

Script F.A Cross-sell (No ADVISOR)

Script F.A Cross-sell (Advisor Received Low rating)

Script F.A Cross-sell (Advisor Received High rating)

Rate Movement Article

EMAIL- To Schedule Rate Lock Strategy Discussion

EMAIL- Closing cross-sell refi (re-Allocate)

EMAIL- Lock Specialist introduction

EMAIL- No Reply Follow Up

EMAIL- F.A Referral (no advisor)

EMAIL- F.A Referral (advisor received low rating)

EMAIL- F.A Referral (advisor received high rating)

EMAIL- F.A Referral (to client In-process)

Email RE: Financial Advisor Closing Cross-Sell Referral (w/Total Cost Analysis)

Email RE: Financial Advisor Closing Cross-Sell Referral (Client has F.A)

Mortgage Module #8

Checklist - Mortgage Module #8

Rate Confirmation Email

Loan Program confirmation email

Mortgage Module #9

Checklist - Mortgage Module #9

P&C Full Coverage Email Cross-Sell

P&C Follow Up Email

P&C Refi Cross-Sell email

P&C Cross-Sell email purchase

P&C Corporate Benefit E-Mail

P&C Corporate Benefit Announcement

Mortgage Module #10

Checklist - Mortgage Module #10

LUNCH & LEARN- Team Services Discount

LUNCH & LEARN- Existing Client Realtor Benefits

LUNCH & LEARN- Rate Watch

LUNCH & LEARN- Pre-Approval Flyer

LUNCH & LEARN- Overview

LUNCH & LEARN- Existing Client Mortgage Benefit

LUNCH & LEARN- Legal Services Discount

LUNCH & LEARN- H.R Flyer

LUNCH & LEARN- H.R Flyer

LUNCH & LEARN- H.R Flyer

LUNCH & LEARN- H.R Flyer

LUNCH & LEARN- H.R Flyer

LUNCH & LEARN- H.R Flyer

LUNCH & LEARN- H.R contact email

LUNCH & LEARN- Client permission E-mail

LUNCH & LEARN- Attorney/Escrow Officer Flyer

LUNCH & LEARN- SAMPLE Seminar

Mortgage Module #11

CHECKLIST - Mortgage Module #11

POST CLOSING SURVEY

MID PROCESS SURVEY

POST CLOSING SURVEY EMAIL

MID PROCESS SURVEY EMAIL

Mortgage Module #12

CHECKLIST - Mortgage Module #12

Why do I have to bring $ to closing when I'm doing No pts/No Closing?

Rate Lock Reminder

Email RE: NPNC Refinance

Email- RE: Closing Costs

Email- RE: 7-10 Days Before Closing

Mortgage Module #13

CHECKLIST - Mortgage Module #13

Script - Introduce Rate Watch

Email-Desired Rates

Script - Desired Rate

Script - Financial advisor intro

Script - Financial advisor intro (If Pushback)

Should i refinance doc.

Rate Watch Form

POST CLOSING SURVEY

Refinance Proposal Email

Rates Have Dropped Email

Rate Watch Email

Email- RE: Rate Watch Offer To a Financial Advisor

Closing Cross Sell F.A/E.P.A Email

Financial Advisor Closing Cross Sell

Email-Financial Advisor Closing Cross Sell

Mortgage Protection Insurance Cross-Sell- F.A-Email

Financial Advisor Introduction Email

Email-Financial Advisor Closing Cross Sell By R.E Attorney/Escrow Officer

Mortgage Module #14

CHECKLIST - Mortgage Module #14

Script-Advisor Follow Up

November Accountant Endorsement Letter

January Accountant Endorsement

HUD-1 Statement Accountant letter

3 Month Cross-Sell Email

6 Month Cross-Sell Email

Partner introduction email request

1 Month after Closing Realtor Endorsement

1 Month after Closing Advisor Endorsement

1-3 Month after Closing F.A Cross-Sell Letter

Financial Advisor Introduction Email

Mortgage Module #15

CHECKLIST - Mortgage Module #15

SCRIPT : REQUEST INTRODUCTION PERMISSION

Script to offer a Mortgage Review

Script to offer an Equity Review (Realtor referral)

MORTGAGE REVIEW

EMAIL to set up a Loan Structure Call

MORTGAGE REVIEW (If No response email)

ANNUAL MORTGAGE REVIEW

ANNUAL MORTGAGE REVIEW EMAIL INTRODUCTION

Birthday Email

THE RELATIONSHIP BUILDER

THE CORE7 RELATIONSHIP BUILDER

MORTGAGE FACT FINDERS

Core7 Loan Application that Populates

Mortgage Planning Questionnaire that Populates

THE CORE7 FINANCIAL ADVISOR

FINANCIAL PROFESSIONAL MODULE #1.

What's Your Rate? E-Book

FINANCIAL PROFESSIONAL MODULE #2.

CHECKLIST - Financial Professional Module #2

Script to segue in discussing the Wealth Strategy Analysis (W.S.A)

Script- W.S.A is declined

Script to schedule Cash-Flow Analysis

CHECKLIST - Financial Professional Module #2

Script- Permission to follow up

Script to request permission to send the Wealth Strategy Analysis (W.S.A)

Script when the Cash-Flow Analysis is not returned

Email follow-up to the Lender's Closing Cross Sell

Email follow-up to the Lender's Referral

Email follow-up by the Lender if there is NO RESPONSE

Core7 Cash-Flow Analysis

FINANCIAL PROFESSIONAL MODULE #3.

CHECKLIST - Financial Professional Module #3

SCRIPT RE: Vacation Spending

SCRIPT RE: Personal Spending

SCRIPT RE: Entertainment Spending

Do's & Don'ts When Obtaining A Mortgage

Core7 Cash-Flow Analysis

CHECKLIST - Financial Professional Module #3

FINANCIAL PROFESSIONAL MODULE #4

Core RVQ

CHECKLIST - Financial Professional Module #4

SCRIPT RE: Relationship Visualization Question example to guide the client

SCRIPT to ask the Relationship Visualization Question

Core7 Relationship Visualization Question (R.V.Q)

FINANCIAL PROFESSIONAL MODULE #5.

FINANCIAL PROFESSIONAL MODULE #5.

Core7 RVQ and TOA

Core7 TOA

CHECKLIST - Financial Professional Module #5

SCRIPT to ask questions on The T.O.A (Threats, Opportunities, & Advantages)

Script to acknowledge frustration

Core7 T.O.A (Threats, Opportunities, & Advantages Document)

Core7 RVQ and TOA

Core7 TOA

CHECKLIST - Financial Professional Module #5

SCRIPT to ask questions on The T.O.A (Threats, Opportunities, & Advantages)

Script to acknowledge frustration

Core7 T.O.A (Threats, Opportunities, & Advantages Document)

FINANCIAL PROFESSIONAL MODULE #6

Core7 Wealth Strategy Analysis WSA

SCRIPT: CORE7 WSA PREPARATION

SCRIPT: RENTAL INCOME REALTOR CROSS SELL

CORE7 REFERRAL SCRIPT WHEN A CLIENT DOES NOT HAVE AN ADVISOR

SCRIPT: LUNCH & LEARN CROSS SELL

SCRIPT: LOAN RESTRUCTURING EQUITY REVIEW REALTOR CROSS SELL

SCRIPT TO INTRODUCE THE WEALTH STRATEGY ANALYSIS (W.S.A)

SCRIPT: INFREQUENT CONTACT ADVISOR REFERRAL

SCRIPT: INFREQUENT CONTACT ADVISOR REFERRAL

SCRIPT: GOOD RELATIONSHIP ADVISOR NETWORKING

SCRIPT: GOOD RATE LENDER CROSS SELL

SCRIPT: EQUITY ANALYSIS REALTOR CROSS SELL

SCRIPT: POOR RELATIONSHIP ADVISOR REFERRAL

CORE7 WEALTH STRATEGY ANALYSIS (W.S.A)

CHECKLIST - Financial Professional Module #6

FINANCIAL PROFESSIONAL MODULE #7.

Core7 Action Letter

Core7 Action Worksheet

CHECKLIST - Financial Professional Module #7

Core7 Action Worksheet

Core7 Action Worksheet & Letter

Core7 Action Letter

FINANCIAL PROFESSIONAL MODULE #8.

Core7 Action Letter

Core7 Action Worksheet

CHECKLIST - Financial Professional Module #8

Email to schedule the Action Plan

Core7 Action Worksheet

Core7 Action Letter

FINANCIAL PROFESSIONAL MODULE #9.

Script to introduce the Quarterly Financial Review (Q.F.R)

CHECKLIST - Financial Professional Module #9

FINANCIAL PROFESSIONAL MODULE #10.

CHECKLIST - Financial Professional Module #10

FINANCIAL PROFESSIONAL MODULE #11

CORE7 WEALTH STRATEGY ANALYSIS (W.S.A)

CHECKLIST - Financial Professional Module #11

SCRIPT- Mortgage Management Cross Sell

CORE7 WEALTH STRATEGY ANALYSIS (W.S.A)

CORE7 Cash-Flow Analysis

FINANCIAL PROFESSIONAL MODULE #12.

THE CORE7 RELATIONSHIP BUILDER

CHECKLIST - Financial Professional Module #12

THE CORE7 RELATIONSHIP BUILDER

THE CORE7 REAL ESTATE AGENT

Realtor Module #1

Email to send with Buyer Questionnaire

Core7 Realtor Home Buying Checklist

Core7 Realtor Buyer Questionnaire

Core7 Realtor Seller Questionnaire

Realtor Scripting

Realtor Module #2

Email to send with Buyer Questionnaire

Core7 Realtor Home Buyer Questionnaire

Core7 Realtor Home Seller Questionnaire

Core7 Realtor Home Buying Checklist

Home Buying Checklist 2

Realtor Module #4

Core7 Realtor Home Buyer Power point Presentation

Realtor Module #5

REALTOR- Primary & Secondary Referral Target Scripts

Realtor Module #6

Core7 Realtor Showings & Guidelines

Realtor Module #7

Offer Cover Letter

Realtor Module #8

Core7 Realtor Transaction Sheet

Realtor Module #12

Email - Walkthrough & Closing Reminders

Core7 Realtor Walk Through

Realtor Module #15

Core7 Realtor Equity Review

CHEF'S TABLE MODULE

Chef's Table Checklist

For Realtors who want all the granular details of how they should do an inspection, walkthrough, etc. These are the details from Chuck Silverston, a Core7 real estate agent who is averages over 50 closings a year.

Core7 Realtor Showings & Guidelines

Core7 Realtor Inspection

Core7 Realtor Walk Through

The Core7 Relationship Builder

Core7 Relationship Builder

Loan Officer/Financial Advisor Partnerships

Module #5: Prospecting For Financial Advisors

Financial Advisor Prospecting Letter/Email

Financial Advisor Prospecting Follow Up Email

Financial Advisor Prospecting No Response Email

Financial Advisor Prospecting: Client gives FA a High Rating

Financial Advisor Prospecting Email during the loan process

Financial Advisor Prospecting Script: Client gives FA a High Rating

Module #7: Interviewing The Financial Advisor (Questionnaire Included)

Financial Advisor Presentation & Questionnaire Overview

Financial Advisor Questionnaire & Presentation

Module #8: The Unique Loan Officer Presentation That Financial Advisors Will Love

Mortgage Planning Questionnaire #1

Mortgage Planning Questionnaire #2

Module #9: The Mortgage Review & The 2 Magic Questions To Generate Referrals

Mortgage Review

Mortgage Review Request

Mortgage Review Introduction

Why Reverse Mortgage Are An Essential Tool In A Clients Overall Financial Plan Pt #1

3 Bucket PDF

Reverse Mortgage Financial Advisor Presentation

3 Bucket Presentation for Financial Advisors

Bucket Sheet

Awesome Realtor/Loan Officer Partnerships

Module #3: The Process

Chuck's Buyer Questionnaire

Chuck's Powerpoint Presentation w/Training Video (This can be branded as your own)

Module #7: The Questions To Ask a Lender As a Listing Agent

Core7 Seller Questionnaire

The First Time Homebuyers Toolkit

Module #1: E-Book: How To Buy A Home & Secure Your Financial Future At The Same Time

E-Book: How To Buy A Home & Secure Your Financial Future At The Same Time

EBook

REAL ESTATE & FINANCIAL TOOLS

Balance Sheet

Profit & Loss

Net Proceeds Worksheet

Investment Property Analysis

FORMS & INFORMATION

What's Your Rate? Step By Step Process

Loan Application

What isn't covered by your Homeowners Insurance

Mortgage Planning Questionnaire

Hand Out: Rate Movement

FAQ's About Mortgages

Documentation Checklist

Do's & Don'ts

Buyer Questionnaire

Basics Of Title Insurance

Module #1: First Steps When Looking To Buy

Home Buyer Questionnaire

Module #2: Making An Offer

Home Buyer Checklist

Module #5: The Mortgage Process

What Makes Interest Rates Move?

How Much Are The Closing Costs

The Do's & Don'ts When Applying For A Mortgage

Documentation Checklist

Mortgage Planning

Questionnaire

Mortgage Application

Module #6: The Next Steps After An Accepted Offer

Closing Cost Breakdown

Module #8: Value After The Closing

Relationship Builder

Module #9: First Steps When Selling A Property

Home Seller Questionnaire

Net Proceeds Worksheet

Interview with a Core7 Estate Planning Attorney: The top Estate Planning tips that a First Time Homebuyer needs to consider.

Estate Planning Questionnaire

Interview with a Core7 Financial Advisor: The top Financial Planning tips that a First Time Homebuyer needs to consider.

Wealth Strategy Analysis: Fact Finder

Financial Fact Finder: Business Owner Specific

Interview With A Core7 Accountant: The top Tax Planning tips that a First Time Homebuyer needs to consider.

Tax Planning Questionnaire

Interview with a Core7 Property & Casualty Insurance Agent

P&C Insurance Client Questionnaire